Many steps are being taken by the Government of India towards alleviating the pains of senior citizens. One such effort is reaching out to super senior and immobile citizens, in RBI directing the officials of the bank to get the life certificates by visiting them, at a mutually convenient time. One of the laudable steps towards submission of Life Certificate (LC) by pensioner, which is required to be given once in a year normally in November for Bank pensioners, is to introduce submitting them electronically. The scheme was inaugurated way back in 2014, but it took so much of time for many banks to bring in the systems in place to enable the Pensioners to submit Digital Life Certificate (DLC). This is a boon to the pensioners, particularly those who are away from India to be with their children towards mutual support.

Through some followups, support and gathering data, I was able to submit the DLC for the first time, yesterday (29-Nov-2019) from home and this post is an attempt to walk through the steps I took, so that it could be of some guidance and use to others who want to emulate. I would hasten to add that these are the steps 'I took' towards successful completion of this task and it is to be noted that the hardware or the approach adopted here are not 'the' method and there could be many more, better and efficient ones too !

Hardware used:

a. A Laptop with Windows 10

b. Mantra MFS100 Finger Print Scanner (refer picture below)

I spoke to many who were using such FP scanners and also to one who is actually running a business organization, supporting pensioners in submitting DLC. In fact, Canara Bank , in its circular has mentioned eight such machines but, I was recommended this and so used this. This is available at Amazon (https://www.amazon.in/ ) or one could also get directly by approaching the manufacturers (refer: https://www.mantratec.com/ )

Following are recommended steps based on my experience:

4. For the hardware, I was using as referred above, visit the website: https://download.mantratecapp.com/Forms/DownLoadFiles

5. Download the Driver: MFS100Driver (Refer: Below)

6. Download the Driver: MantraRDService

Following are the Downloads made:

7. Double click on all application files (in your downloads folder) and install all of them, guided by the prompts made

Aadhaar Authentication:

8. Double click on Jeevan Pramaan shortcut on your desktop , which should appear like this :

9. Provide all details requested in the screen, as below:

10. On giving the required inputs, a OTP is sent to both the Mobile number and email.

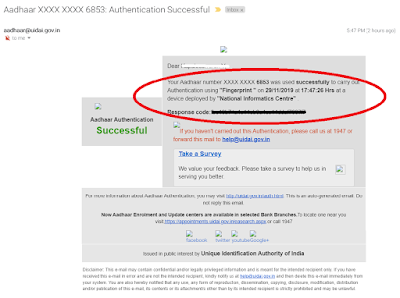

11. When successfully given, a confirmation email is sent, with a reference code as below:

To Generate Digital Life Certificate:

12. Again click on Jeevan Pramaan shortcut (as in step-8 above)

13. A screen from Life Certificate System will appear as below:

14. To complete the above , following details were provided :

15. An acknowledgement screen will then flash as below:

You can print the DLC, if a printer is connected to your device

Through some followups, support and gathering data, I was able to submit the DLC for the first time, yesterday (29-Nov-2019) from home and this post is an attempt to walk through the steps I took, so that it could be of some guidance and use to others who want to emulate. I would hasten to add that these are the steps 'I took' towards successful completion of this task and it is to be noted that the hardware or the approach adopted here are not 'the' method and there could be many more, better and efficient ones too !

Hardware used:

a. A Laptop with Windows 10

b. Mantra MFS100 Finger Print Scanner (refer picture below)

I spoke to many who were using such FP scanners and also to one who is actually running a business organization, supporting pensioners in submitting DLC. In fact, Canara Bank , in its circular has mentioned eight such machines but, I was recommended this and so used this. This is available at Amazon (https://www.amazon.in/ ) or one could also get directly by approaching the manufacturers (refer: https://www.mantratec.com/ )

Following are recommended steps based on my experience:

- Visit the Jeevan Pramaan website: https://jeevanpramaan.gov.in/

- Go to its 'Download' page, as shown below:

4. For the hardware, I was using as referred above, visit the website: https://download.mantratecapp.com/Forms/DownLoadFiles

5. Download the Driver: MFS100Driver (Refer: Below)

6. Download the Driver: MantraRDService

Following are the Downloads made:

7. Double click on all application files (in your downloads folder) and install all of them, guided by the prompts made

Aadhaar Authentication:

8. Double click on Jeevan Pramaan shortcut on your desktop , which should appear like this :

10. On giving the required inputs, a OTP is sent to both the Mobile number and email.

11. When successfully given, a confirmation email is sent, with a reference code as below:

To Generate Digital Life Certificate:

12. Again click on Jeevan Pramaan shortcut (as in step-8 above)

13. A screen from Life Certificate System will appear as below:

14. To complete the above , following details were provided :

a.

Type of Pension is ‘Service’

b.

Sanctioning Authority is ‘Banking Staff’

c.

Disbursing Agency is ‘Bank’

d.

Agency 'Indian Overseas Bank' was chosen

e.

After providing all the details, DO NOT FORGET to tick the Check

box near “I the holder of Aadhaar…” and keep your finger (I kept Left hand

thumb) firmly on the specified place in the scanner

You can print the DLC, if a printer is connected to your device

16. An SMS will come on the mobile as below:

17. An email will also be received as below:

To Print the Digital Life Certificate:

18. Click on the link provided in the email acknowledgement

19. You will be led to a page as below:

19. On providing the Pramaan ID, a screen will appear as below:

20. Click on 'Download Life Certificate', from where the LC could be downloaded in pdf format

21. Note to Logout , after completion of the task.

Some points to ponder:

A. The above procedure was adopted by me for submitting DLC from my laptop. For using mobile, it may vary and I guess some Apps are also to be used for this purpose

B. As already mentioned above, there are many finger print scanner devices available in the market. On my analysis, this appeared to be popular and so I used this. One could analyze and choose according to their comfort level.

C. I feel this facility of DLC will be more useful for Pensioners who are away from India, as the OTP comes both through the mobile as well as through Email and people away from India should enjoy this instead of dependence on OTP through mobile only. Of course, for whose who are in India and could afford, a better method will be to go to ANY branch and submit the LC, until the system and staff settle down with the procedure.

Some queries and my suggested responses:

1. Will submission of Digital Life Certificate be accepted by our Bank?

Answer: Facility of DLC is provided by the Government of India and a bank does not have any option of accepting or otherwise. RBI in its circular (given below) has clearly directed the banks to create awareness about facility of DLC through its branches, website and other means.

2. Is Digital Life Certificate facility available for our Bank Pensioners?

Answer: Our Bank circular clearly states that the " ....branch can update Life Certificate through Jeevan Pramaan ..."- See extract of the circular below:

3. Should the pensioner (after submitting Digital Life Certificate through Jeevan Pramaan) , go to his/her Pension branch and submit details?

Answer:

As per law - "Not Necessary", as the above mentioned circulars from RBI and IOB clearly state that the Pension Disbursing Authority (PDA) could get the updated status of the Life certificate of Pensioners from the Jeevan Pramaan website. Please also refer to the Jeevan Pramaan FAQ , quoted below:

However, in Banking we are used to Law and Practice ! So, to be on the safer side, the individual pensioner could track the status through Retirees Portal, where the status is updated. Also, one could meet the Pension officer and inform him/her about submitting DLC. Normally, experiences, as shared by some other Bank Retirees, is that the Pension officer asks for the Pramaan ID to extract the DLC. Though not required to share, one could give this just to ensure that the process is complete and that the pension continues to be credited.

4. Even after submitting DLC, will the pensioner be asked to come to the branch to sign physical copy of the Life certificate?

Answer: No need, as explained above. At best, the pensioner could direct the Pension officer to get the DLC.

5. Life Certificate issued under Jeevan Praman is essentially based on biometric authentication. One cannot do this at home simply based on aadhaar OTP

6. “. . . as any one can

misuse it after the life time of pensioner. . . “

7. “… Pension Payment Authority should have been enrolled under the scheme and will issue a notification to pensioners that Life Certificate under Jeevan Praman will be accepted….”

Answer: Very True.

9. “So far I have not come across any circular issued by our Bank (IOB) on the acceptability of Life Certificate under Jeevan Praman.”

Answer:

It is already done by IOB- Please refer IOB circular 7D-26 of 24.09.2018 and also the latest circular LC_7F_105_2019_NOV_01, wherein it is clearly stated about submission of Digital Life certificate through Jeevan Pramaan – Refer: Y_IOB_CIRCULAR, below

Answer: Not necessary. The DLC is available to the Pension Disbursing Authorities electronically and they can download them- Refer: DLC_to_bank below:

17. An email will also be received as below:

To Print the Digital Life Certificate:

18. Click on the link provided in the email acknowledgement

19. You will be led to a page as below:

19. On providing the Pramaan ID, a screen will appear as below:

20. Click on 'Download Life Certificate', from where the LC could be downloaded in pdf format

21. Note to Logout , after completion of the task.

Some points to ponder:

A. The above procedure was adopted by me for submitting DLC from my laptop. For using mobile, it may vary and I guess some Apps are also to be used for this purpose

B. As already mentioned above, there are many finger print scanner devices available in the market. On my analysis, this appeared to be popular and so I used this. One could analyze and choose according to their comfort level.

C. I feel this facility of DLC will be more useful for Pensioners who are away from India, as the OTP comes both through the mobile as well as through Email and people away from India should enjoy this instead of dependence on OTP through mobile only. Of course, for whose who are in India and could afford, a better method will be to go to ANY branch and submit the LC, until the system and staff settle down with the procedure.

Some queries and my suggested responses:

1. Will submission of Digital Life Certificate be accepted by our Bank?

Answer: Facility of DLC is provided by the Government of India and a bank does not have any option of accepting or otherwise. RBI in its circular (given below) has clearly directed the banks to create awareness about facility of DLC through its branches, website and other means.

2. Is Digital Life Certificate facility available for our Bank Pensioners?

Answer: Our Bank circular clearly states that the " ....branch can update Life Certificate through Jeevan Pramaan ..."- See extract of the circular below:

3. Should the pensioner (after submitting Digital Life Certificate through Jeevan Pramaan) , go to his/her Pension branch and submit details?

Answer:

As per law - "Not Necessary", as the above mentioned circulars from RBI and IOB clearly state that the Pension Disbursing Authority (PDA) could get the updated status of the Life certificate of Pensioners from the Jeevan Pramaan website. Please also refer to the Jeevan Pramaan FAQ , quoted below:

However, in Banking we are used to Law and Practice ! So, to be on the safer side, the individual pensioner could track the status through Retirees Portal, where the status is updated. Also, one could meet the Pension officer and inform him/her about submitting DLC. Normally, experiences, as shared by some other Bank Retirees, is that the Pension officer asks for the Pramaan ID to extract the DLC. Though not required to share, one could give this just to ensure that the process is complete and that the pension continues to be credited.

4. Even after submitting DLC, will the pensioner be asked to come to the branch to sign physical copy of the Life certificate?

Answer: No need, as explained above. At best, the pensioner could direct the Pension officer to get the DLC.

5. Life Certificate issued under Jeevan Praman is essentially based on biometric authentication. One cannot do this at home simply based on aadhaar OTP

Answer: No , one can do it from home.

a. Jeevan

Pramaan FAQ states that it can be generated from Home. Please refer to the screenshot below:

b. IOB

circular 7D-26 of 24.09.2018 also confirms this. Please refer to the extract of

the circular which is given below

7. “… Pension Payment Authority should have been enrolled under the scheme and will issue a notification to pensioners that Life Certificate under Jeevan Praman will be accepted….”

Answer: Very True.

a. IOB has

already been notified about this – Kindly refer to Jeevan Pramaan list dated

10-Oct-2019, downloaded from JP website – Refer enclosure: DLC_PDA_Authority_1

b. IOB has

also mentioned about this in its circular 7D-26 of 24.09.2018 requesting

branches to sensitize about the JP scheme and its process

c. IOB in its

circular 7-D no: 30 of 25.10.2018 has already confirmed that “Jeevan Pramaan

has been implemented in our bank since 2015..” – See enclosure

DLC_PDA_Authority_2

8. “… Pensioner has to go to the Authorised centers/ outlets ,

where one can submit Life Certificates using bio metric authentication …”

Answer:

No, Not necessary. If one has the infrastructure, then one

can generate DLC , even from home, as quoted above

9. “So far I have not come across any circular issued by our Bank (IOB) on the acceptability of Life Certificate under Jeevan Praman.”

Answer:

It is already done by IOB- Please refer IOB circular 7D-26 of 24.09.2018 and also the latest circular LC_7F_105_2019_NOV_01, wherein it is clearly stated about submission of Digital Life certificate through Jeevan Pramaan – Refer: Y_IOB_CIRCULAR, below

Answer: Not necessary. The DLC is available to the Pension Disbursing Authorities electronically and they can download them- Refer: DLC_to_bank below: